Recently, we had the pleasure of working with two large Sureties during the same week. It was a fascinating experience; to be able to interact and survey two very distinct corporate cultures solidified some of our thinking about a new generation of Surety Bond Professionals.

Over the last five years, the volume of data and debate about Millennial learning habits has been nothing short of astounding. With the advent of big data and social media, we know (or think we know) more about this generation’s learning styles, habits, and preferences than any generation of adults in history. Certainly, more has been written.

In numerous recent surveys, corporate leaders placed “communication skills” at the top of desired new-hire skills. Accordingly, companies have been developing learning strategies to fill the skill gap for going on a decade. Nowhere has the skill gap been more discussed than the insurance and financial industries. In our learning and development efforts across a wide swath of these industries, we are continually impressed and intrigued by an industry that gets little notice for actually building those learning strategies into the day-to-day: Surety.

In two surety versions of our writing course, Write On Target, we often start sessions with a survey of reader habits. We give participants a selection of varying-length industry sample documents, and query them about not what they are reading, but how. This activity gives self-awareness into how readers often engage (or don’t engage) with business documents.

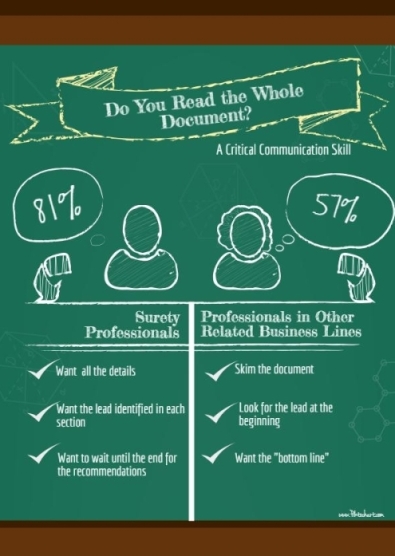

What was remarkable, but not surprising, about these two sessions is that surety professionals read business documents completely differently than insurance and financial groups we have surveyed. Among our surety groups, 81% of participants read the entire document, start to finish, versus approximately 57% of other related business-line groups.

Why is Surety Different than Other Business Lines in How It Communicates?

Surety teaches the rare 21st century communication skill that the whole document can be enlightening and crucial to successful action and decision-making. After all, when we skim, we entrust the writer with the task of organizing and highlighting critical information for us—a skill that, in our experience, most writers struggle with. In an environment where over 65% of business email messages are read on mobile devices, document skimming has become the norm rather than the exception.

A quick test: take a moment and ask yourself, how am I reading this document? For that matter, how did I read the last few email messages I opened?

Contrary to popular belief, we’ve found that skimming isn’t really affected by the length of the document. In fact, in our survey, when we give groups documents of varying length, skimming typically kicks in at about the same spot for nearly any document: somewhere in the second paragraph.

What Does Surety Do Differently?

Interestingly and somewhat anachronistically, surety new hires are taught the critical communication skill that the entire document—every section—contains important information necessary for decision-making. Of course, this is true in a great many documents, but it’s the diligence with which surety training groups and mentors focus on this fact that separates the industry.

In fact, we are often told stories by our millennial participants where a home office or a branch manager will sit with them, sometimes at great length, to dissect an entire submission, financial by financial, project by project. It’s clear in the retelling that some of these sessions come across as redundant and time-consuming to a bond pro or underwriter certain about a recommendation. But what is clear is that this diligence, this consistency, this close reading and analysis creeps into young surety professionals habits as well. Are these surety groups realizing something that the rest of us could benefit from?

We often poke fun by joking that every surety submission’s Ownership and Continuity section begins with the company’s founding right after the Civil War and ends with the current owner hoping that his oldest child will “find himself” soon and start learning the business.

But think of the submissions and annual updates you’ve read lately—how far off is that from the tone that our surety writers usually set?

And it’s clear in the writing and analysis skills of young surety professionals that this intense detail is not necessarily a bad thing. In surety’s unique environment, storytelling is a necessity. Because each surety has different risk aversion and business appetite, we find amazing consistency in how young surety writers are trained in thoroughness of analysis. Home office colleagues need to understand a company’s narrative, and they need to experience a potential partner’s culture (in additional to their financials and operations) to make informed decisions about how they fit within the surety’s underwriting appetite.

Our focus with surety professionals is to help them communicate that narrative slightly more effectively.

How Do You Teach Surety Professionals to Keep the Story but Streamline Their Documents?

We teach that, with rare exception, placing the most important information at the beginning of the document is a great strategy. Even in the storytelling realm of surety, this strategy benefits the writer, and more importantly, the reader. The reader that is pressed for time or the reader that is simply looking for the “bottom line” can easily find the crux of the message. For those readers that would like or need more information, adding those details immediately following the lead of your message is an effective strategy.

Of course in surety, it’s not always quite that easy. When we introduce our simple, time-tested, almost institutionalized philosophy of “leading with lead,” we get tremendous resistance from home office surety underwriters. This, simply put, is just not how they do things. And frankly, it’s refreshing. Where do you ever hear in 2015 “tell me the whole story first,” “I don’t want a snapshot,” “tell me more,” “give me all the details”?

So some adjustments have to be made with surety learning. Writers are typically taught that the main underwriting recommendation should typically be held until the end of the document, even though that is almost always the key lead for a submission.

Instead, we seek to alter the narrative that leads to the recommendation. Writers are slightly rewired to identify a lead in each section and format and organize appropriately—what’s the lead in financials, what’s the lead in work on hand, what’s the lead in business continuity, and so on.

Another key update that most surety documents need is simple formatting. For example, a Financials section in paragraph form? There’s really no logical reason for it other than tradition. But surprisingly, many sureties continue to use that outdated format.

Those changes are easy ones. And if we can build a culture where each section leads with critical information, not only can we tell the entire rich narrative, but we can also keep the text moving in a way that encourages readers not to inadvertently miss crucial information that might otherwise be buried in the text.

Our surety groups have reinforced our belief that there are people out there who are willing to read an entire document rather than skimming. Even our younger surety groups have shown us that they can build the skill of storytelling and engage audiences more fully than the national average.

That foundation of deep, engaged reading and storytelling sureties teach newer hires links wonderfully to their recent academic training. And we believe that foundation sets millennial employees up for communication success as they advance into their careers. After all, it’s pretty easy to learn how to skim. Learning how to read: that’s another story.

–Mike Mannon and Patrick Sullivan, WD Communications